Mastering The Closing Revenue Accounts Journal Entry

When it comes to accounting, the process of closing revenue accounts is an essential step that helps businesses maintain accurate financial records. This crucial activity not only ensures that companies can assess their performance over a specific period but also prepares them for the upcoming fiscal year. Understanding how to create an effective closing revenue accounts journal entry is vital for any accountant or business owner looking to streamline their financial operations.

By closing revenue accounts, businesses can transfer the balances from temporary accounts to permanent ones, effectively resetting the revenue accounts for the new accounting period. This process allows for a clear view of revenue earned during the reporting period, facilitating better decision-making and financial analysis. In this article, we will explore the intricacies of closing revenue accounts journal entries and provide valuable insights into their importance in financial management.

Furthermore, we will answer common questions about the process, provide step-by-step guidance on making these journal entries, and highlight best practices for effectively closing revenue accounts. By the end of this article, you will have a comprehensive understanding of closing revenue accounts journal entries, equipping you with the knowledge to apply this essential accounting practice in your own business.

What is a Closing Revenue Accounts Journal Entry?

A closing revenue accounts journal entry is the accounting process that involves transferring the balances of temporary revenue accounts to permanent accounts at the end of an accounting period. This is an essential step in the closing process, as it ensures that revenue accounts are reset and ready for the new period. The primary purpose of this entry is to reflect the total revenue earned during the previous period in the financial statements.

Why Are Closing Revenue Accounts Important?

Closing revenue accounts plays a vital role in financial reporting and analysis. Here are a few reasons why this process is significant:

- Helps maintain accurate financial records.

- Allows businesses to analyze performance over specific periods.

- Prepares accounts for the upcoming fiscal year.

- Ensures compliance with accounting principles and standards.

When Should Closing Revenue Accounts Journal Entries Be Made?

Closing revenue accounts journal entries are typically made at the end of an accounting period, which may be monthly, quarterly, or annually. The timing of these entries can vary depending on the business's accounting practices and reporting requirements. It is crucial to establish a consistent timeline for closing entries to ensure accuracy and reliability in financial reporting.

How to Create a Closing Revenue Accounts Journal Entry?

Creating a closing revenue accounts journal entry involves a few key steps:

- Identify all temporary revenue accounts that need to be closed.

- Calculate the total revenue for the period.

- Prepare the journal entry to transfer the balances to the retained earnings account or another permanent account.

- Record the journal entry in the accounting system.

What Does a Typical Closing Revenue Accounts Journal Entry Look Like?

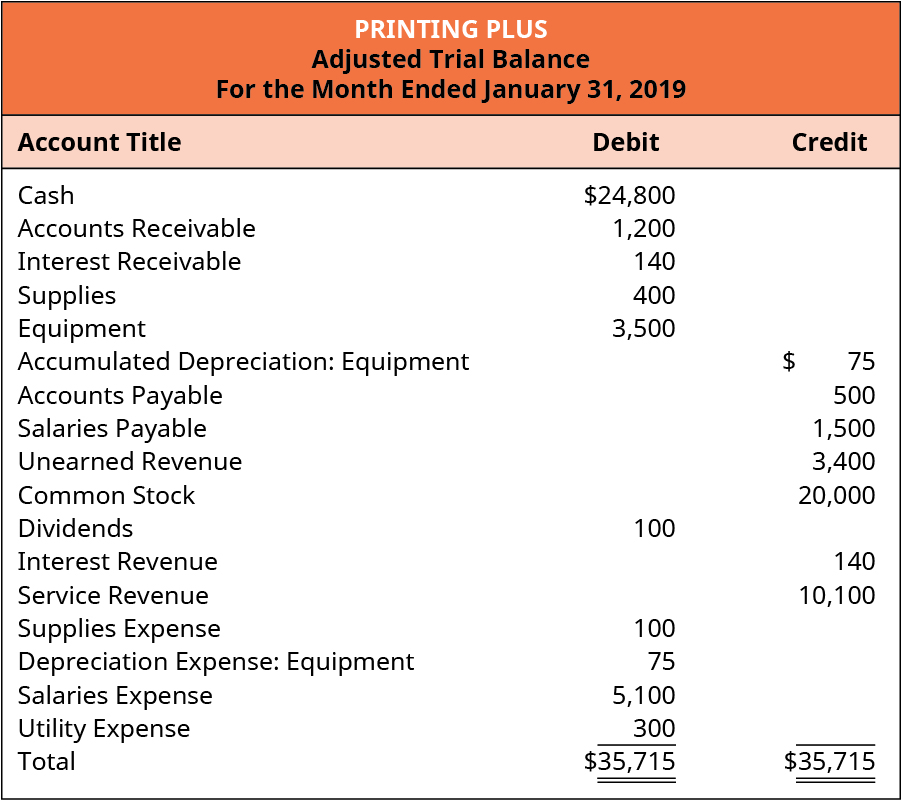

A typical closing revenue accounts journal entry might look like this:

Date Account Title Debit Credit -------------------------------------------------------------- YYYY-MM-DD Revenue Account $X,XXX Retained Earnings $X,XXX

In this example, the revenue account is debited to close it out, while the retained earnings account is credited to reflect the total revenue earned during the period.

What Common Mistakes Should Be Avoided When Closing Revenue Accounts?

When closing revenue accounts, it is essential to avoid common pitfalls, such as:

- Failing to include all temporary revenue accounts.

- Incorrectly calculating total revenue.

- Not recording the journal entry in a timely manner.

- Neglecting to keep accurate documentation of the closing process.

How Do You Ensure Accuracy in Closing Revenue Accounts Journal Entries?

To ensure accuracy in closing revenue accounts journal entries, businesses should adopt best practices such as:

- Regularly reconciling accounts to identify discrepancies.

- Maintaining detailed records of all transactions throughout the accounting period.

- Establishing a checklist for the closing process to ensure all steps are completed.

- Reviewing journal entries with a second set of eyes to catch any errors.

What Role Does Technology Play in Closing Revenue Accounts?

In today’s digital age, technology plays a critical role in streamlining the closing revenue accounts journal entry process. Accounting software can automate many aspects of this process, including:

- Generating accurate financial reports.

- Performing calculations to determine total revenue.

- Recording journal entries automatically, reducing the risk of human error.

- Providing real-time access to financial data for better decision-making.

Conclusion: Mastering the Closing Revenue Accounts Journal Entry

Closing revenue accounts journal entries are a fundamental aspect of effective financial management. By understanding the importance of this process and adhering to best practices, businesses can maintain accurate financial records and gain valuable insights into their performance. Whether you are an accountant, business owner, or finance student, mastering the closing revenue accounts journal entry is an essential skill that will serve you well in your financial endeavors.