Understanding The Frustration Of A Tax Refund Delayed Beyond Normal Timeframe

The anticipation of receiving a tax refund can quickly turn into frustration when it is delayed beyond the normal timeframe. Many taxpayers look forward to this refund as it often represents a significant sum of money that can help alleviate financial burdens or fund personal goals. However, the reality is that various factors can lead to delays, causing anxiety and uncertainty for individuals who are counting on these funds. Understanding the common reasons for tax refund delays and knowing what steps to take can help taxpayers navigate this stressful situation.

When taxpayers experience a delay, they may find themselves asking numerous questions, such as why their refund is delayed, how long they should expect to wait, and what they can do to expedite the process. Additionally, the current tax season may bring unique challenges that could impact the timeline for refunds. These uncertainties can make the waiting period feel even longer, leading to further frustration. With so many individuals relying on their tax refunds, it's crucial to address these concerns and provide clarity on what to expect.

In this article, we will explore the common reasons for tax refund delays, how to check the status of your refund, and what steps you can take if your refund is delayed beyond the normal timeframe. By understanding the ins and outs of the tax refund process, you can feel more empowered and informed as you navigate your financial landscape.

What Are Common Reasons for a Tax Refund Delayed Beyond Normal Timeframe?

Several factors can contribute to a tax refund being delayed beyond the usual processing time. Here are some of the most common reasons:

- Errors on the Tax Return: Mistakes in the filing process, such as incorrect Social Security numbers or misspelled names, can cause delays.

- Missing Documentation: If the IRS requires further information or documentation that was not included with your return, this can hold up the processing.

- Identity Theft Concerns: If the IRS suspects that your identity has been compromised, they may delay your refund until they conduct a thorough review.

- Backlog of Returns: During busy tax seasons, the IRS can experience a backlog, leading to longer processing times.

How Long Should You Wait for Your Tax Refund?

Typically, the IRS processes most tax refunds within 21 days of receiving a return. However, various factors can extend this timeframe. If your refund is delayed beyond this period, it's essential to take action. The IRS suggests checking the status of your refund online for more specific information regarding your case.

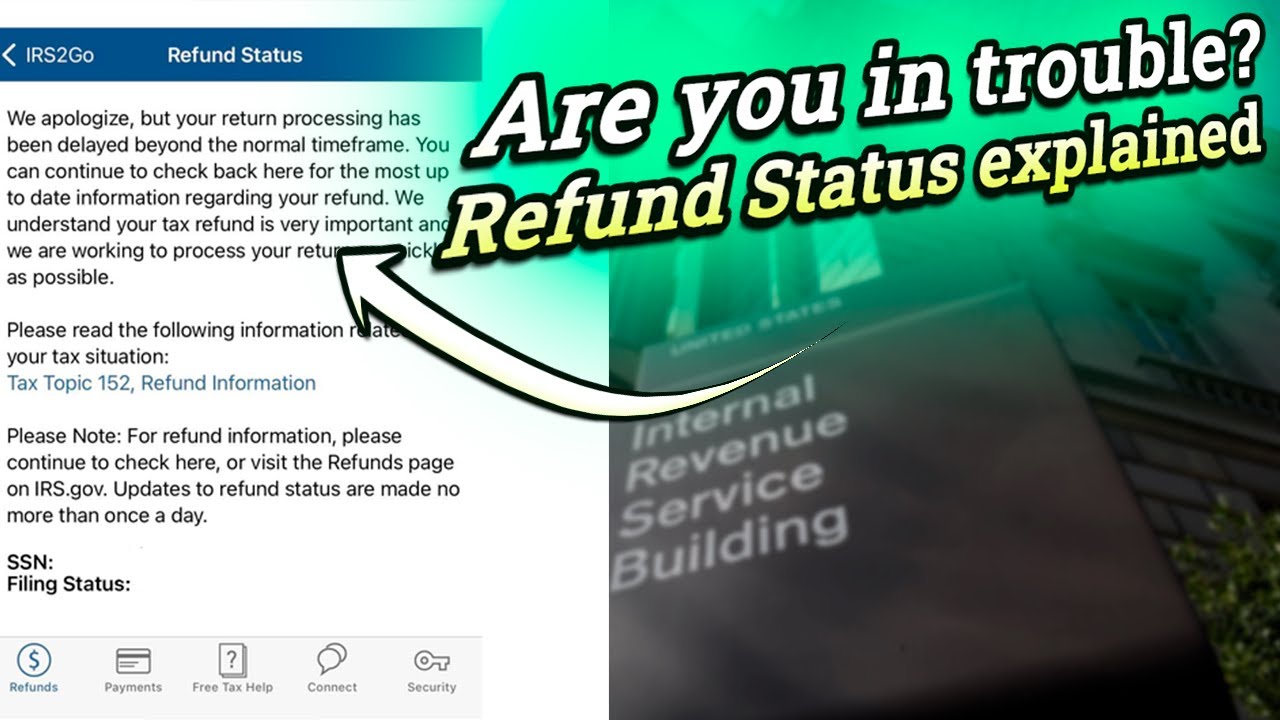

How Can You Check the Status of Your Tax Refund?

To check the status of your tax refund, follow these steps:

- Visit the IRS website and navigate to the "Where's My Refund?" tool.

- Provide your Social Security number, filing status, and the exact amount of your refund.

- Click "Submit" to view your refund status. The tool will provide updates on whether your refund is being processed, approved, or has been sent to you.

What Should You Do If Your Tax Refund Is Delayed Beyond Normal Timeframe?

If your tax refund is delayed beyond the normal timeframe, you may want to consider the following steps:

- Wait a Little Longer: While it can be frustrating, sometimes patience is necessary, especially if you have checked your status and it indicates processing.

- Contact the IRS: If your refund has been delayed significantly beyond the 21-day mark, it may be worth reaching out to the IRS directly for assistance.

- Consult a Tax Professional: If you suspect there may be issues with your return or if you're facing complications, consulting a tax professional can provide clarity and guidance.

What Are the Implications of a Delayed Tax Refund?

Experiencing a tax refund delayed beyond the normal timeframe can have various implications:

- Financial Strain: Many taxpayers rely on their refund to cover expenses, and a delay can lead to unexpected financial challenges.

- Increased Stress: The uncertainty surrounding a delayed refund can lead to anxiety and stress over financial planning.

- Potential Legal Issues: In some cases, if there are discrepancies or issues that arise, it may lead to legal complications that need to be resolved.

Can You Appeal a Tax Refund Delay?

If you believe your tax refund is delayed due to an error or mishandling by the IRS, you may have options for appealing the delay:

- File a Complaint: If all attempts to resolve the issue fail, you can file a complaint with the Taxpayer Advocate Service.

- Request a Review: In certain cases, you can request a review of your case if you believe there has been an unfair delay.

How to Avoid Future Delays in Tax Refund Processing?

To minimize the risk of future delays in receiving your tax refund, consider the following tips:

- File Early: The earlier you file your tax return, the less likely you will face delays due to processing backlogs.

- Double-Check Your Return: Ensure that all information is accurate and complete before submitting.

- Use E-File: E-filing is typically faster and more efficient than filing a paper return.

What Resources Are Available for Taxpayers Facing Delayed Refunds?

If you're dealing with a tax refund delayed beyond the normal timeframe, several resources can assist you:

- IRS Website: The official IRS website provides valuable tools and information for taxpayers.

- Taxpayer Advocate Service: This independent organization helps taxpayers resolve issues with the IRS, including refund delays.

- Local Tax Assistance Centers: Many communities offer local tax assistance resources to help individuals navigate tax-related issues.

In conclusion, while a tax refund delayed beyond the normal timeframe can be frustrating, understanding the potential causes and knowing how to address the situation can help alleviate some of the stress. By staying informed and proactive, taxpayers can ensure they are prepared for any challenges that may arise during the tax refund process.