Understanding The Amount Of Check: A Comprehensive Guide

When it comes to financial transactions, the term "amount of check" plays a crucial role in our everyday lives. Whether you're receiving a check as payment or writing one for your bills, understanding how to identify and verify the amount of a check is essential. It ensures that you manage your finances effectively and avoid potential issues, such as bounced checks or miscommunications with payees. In this article, we will explore various aspects of the amount of a check, from its importance to how to verify it properly.

The amount of a check directly impacts your financial standing, as it reflects the sum of money being transferred from one party to another. Both the payer and the payee must be aware of this amount to ensure smooth transactions. In addition, knowing how to read a check and what elements to look for can save you from future complications, such as fraud or errors. This guide aims to provide you with the knowledge necessary to navigate the world of checks and their amounts with confidence.

Moreover, with the increasing digitization of banking and financial transactions, it becomes even more crucial to understand how checks work and what the amount signifies. As we delve deeper into this topic, we will address common questions, explore practical tips, and provide insights into handling checks responsibly.

What is the Amount of Check?

The amount of a check refers to the total dollar value specified on the check, representing the payment being made from one party to another. It appears in both numerical and written form to minimize the chances of misunderstanding or fraud. Understanding how checks express their amounts is vital for anyone who engages in check transactions.

Why is the Amount of Check Important?

The amount of a check is important for several reasons:

- It ensures that the correct payment is made for goods or services rendered.

- It helps maintain accurate financial records for both the payer and the payee.

- It prevents disputes between the parties involved in the transaction.

- It allows for better budgeting and financial planning.

How is the Amount of Check Written?

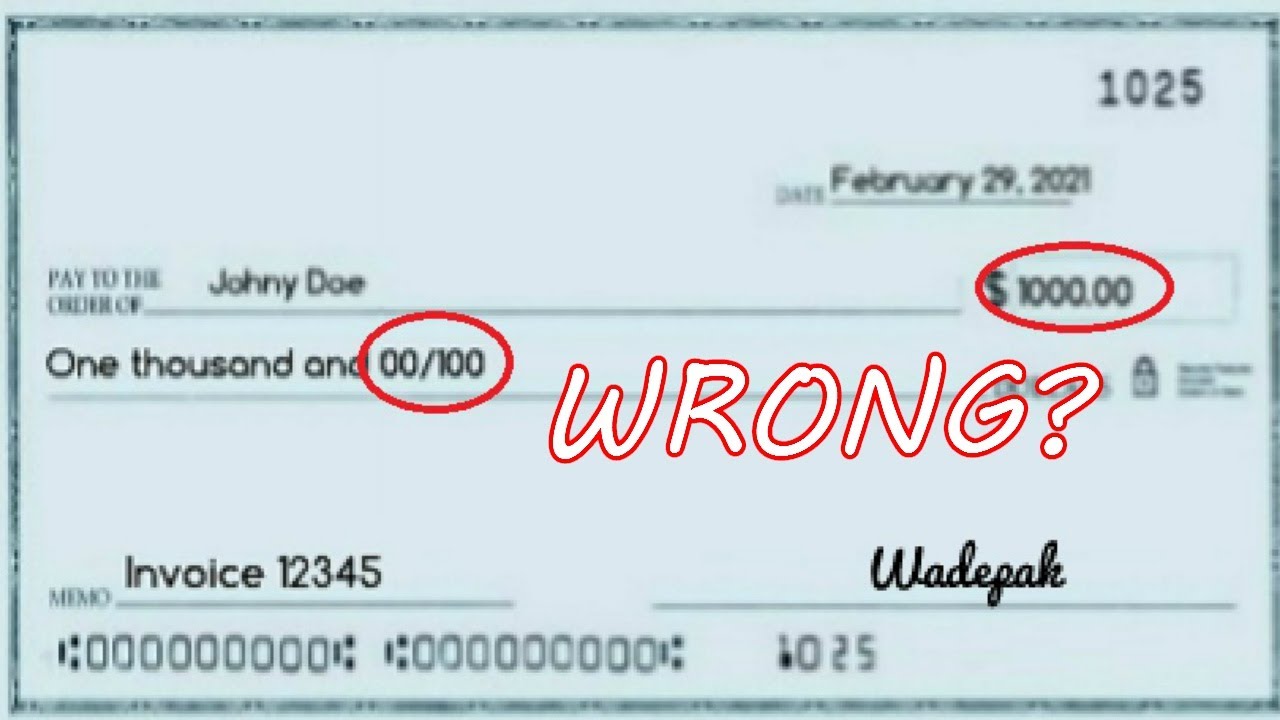

The amount of a check is typically written in two places: in numerical form in the box on the right side and in written form on the line below the payee's name. For example, if the amount is $150.00, it should be written as "One hundred fifty and 00/100." This dual representation helps prevent errors and fraud.

How to Verify the Amount of a Check?

Verifying the amount of a check is crucial to ensure that you are receiving the correct payment. Here are some steps to follow:

- Check the numerical amount in the box on the right side of the check.

- Read the written amount on the line below the payee's name.

- Ensure both amounts match to avoid confusion.

- Confirm that the check is signed properly, as an unsigned check may not be valid.

What to Do if the Amount of Check is Incorrect?

If you discover that the amount of a check is incorrect, you should contact the issuer immediately to discuss the discrepancy. Typically, the issuer will need to void the original check and issue a new one with the correct amount. Maintaining clear communication is key to resolving these types of issues effectively.

Can the Amount of Check Be Changed After Writing?

Once a check has been written and signed, altering the amount is not recommended. If there is a need to change the amount after signing, the check should be voided, and a new one should be issued. This practice helps avoid accusations of fraud and maintains the integrity of the transaction.

What Are the Risks Associated with the Amount of Check?

There are several risks involved when dealing with checks and their amounts:

- Fraud: Unscrupulous individuals may attempt to forge or alter checks.

- Bouncing: If there are insufficient funds in the payer's account, the check may bounce, leading to fees and potential legal issues.

- Disputes: Incorrect amounts can lead to disputes between the payer and payee.

How to Protect Yourself When Handling Checks?

To protect yourself when handling checks, follow these guidelines:

- Always verify the amount before accepting a check.

- Keep good records of all transactions.

- Be cautious of accepting checks from unknown or unreliable sources.

- Consider using electronic payments for added security and convenience.

Conclusion: The Importance of Understanding the Amount of Check

In conclusion, understanding the amount of a check is vital for anyone engaging in financial transactions. By knowing how to read and verify the amount, you can avoid potential issues and ensure that your financial dealings are smooth and efficient. Always be vigilant and proactive in protecting yourself and your finances when handling checks.